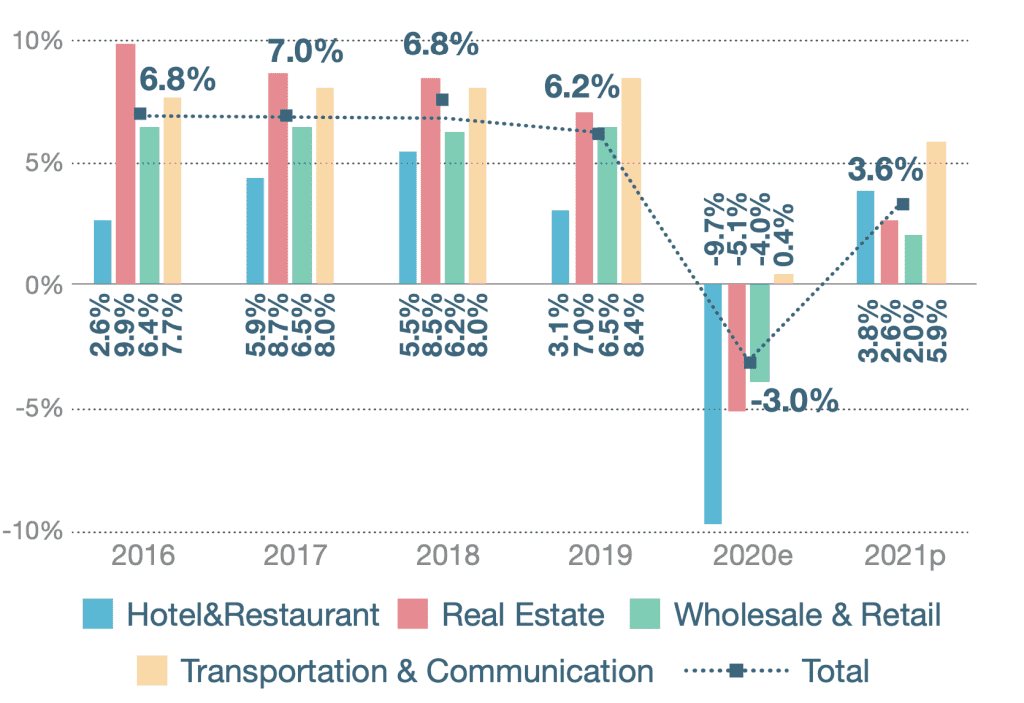

| In the first half of this year, various multilateral/regional development banks provided bullish projections of Cambodia’s economic growth for 2024 and 2025; estimates for this year were in the range of between 5.8% to 6.2%, and even higher for next year.

In their respective updates, the World Bank (WB) and the Asian Development Bank (ADB) estimated a 5.8% growth for Cambodia in 2024, the International Monetary Fund (IMF) predicted a 6.0% growth, while the ASEAN+3 Macroeconomic Research Office (AMRO) had the most bullish projection at 6.2%. Amidst a sluggish property market, which has been a sharp contrast to the pre-Covid bubble years and prior to the ban on online gambling in January 2021, a subdued domestic demand, rising nonperforming loans (NPLs) reported by many banks in the overly crowded financial sector, and tight cash flow for most businesses, are these growth estimates for the Kingdom overly optimistic, or realistic? Yet, these are reports and estimates by reputable international institutions, whose teams of experts meticulously compile relevant data, track and monitor local developments and external factors, and carefully analyze them before their assessment and deliberations are shared publicly. Mr. Ong Teong Hoon, Director and Shareholder Representative of Phillip Bank Plc, shared, “Without the benefit of access to macroeconomic data, my anecdotal observations, coupled with conversations with some business people and bankers, these projections are what we hope to see. The sensing is if this year is not worse than last year, we would be delighted.“ Mr. Roger Dai, General Manager of Capri by Fraser Phnom Penh, said, “As a hotelier, I am confident with the hotel business outlook. Cambodia’s tourism sector is on a recovery path, reported more than 2.5 million air travelers during the first five months of 2024, a year-on-year increase of 22%.” Mr. Chenda Kim, Director and Head of Operations of Indochina Research Cambodia, added, “The latest findings from the ‘IRLight Q2’ 2024 syndicated report of Indochina Research Cambodia shows that the monthly household income (based on respondent claim) still posts continuous slow down over the past 8 quarters. This downward trend can be attributed to job cuts (by 46%), salary reduction (of 29%) and loss of part-time jobs (18%). Although this scenario seems to be at odds with the positive forecasts from the international institutions, we will have to monitor in the coming months, how the government’s efforts to boost economic activities, including infrastructure development and tax reforms, will help alleviate the consumers situation.” What can be gleaned from the aforementioned comments – which are similarly echoed by various other industry experts and contacts – is that there is wariness, or a general state of cautiousness in regard to projections of Cambodia’s growth in 2024 and the following year. The usual caveat is that such estimates will be updated and revised by the reporting institutions over the remaining months ahead, and they will continue to provide useful insights into how the Cambodian economy is faring vis-à-vis the regional and global economic forces and circumstances. At least relative to other countries in Asia and in the Pacific, and more specifically within Southeast Asia, the reporting institutions believe that Cambodia is on the right track towards more sustainable growth. Quick FactsThe projected growth for Cambodia in 2024 is:

Favorable factors and developments:

Challenges ahead:

What needs to be done:

|

Market Info

Bullish Growth Forecasts for Cambodia – What to Make of It?

M&A in Cambodia’s Banking and Finance Industry: 2024 Overview

In recent years, Cambodia’s banking and finance industry has witnessed significant mergers and acquisitions (M&A), highlighting the sector’s dynamic growth and the strategic moves of regional financial institutions. Notable M&A activities include:

- Phillip Bank Plc and Kredit MFI Merger (December 2019): Phillip Bank merged with Kredit Microfinance Institution, creating one of Cambodia’s largest commercial bank branch networks with 89 branches nationwide. This consolidation aimed to leverage Kredit’s deep Cambodian roots and Phillip Bank’s international expertise, especially Singapore, to offer comprehensive financial services and expand outreach across the country.

- KB PRASAC Bank Plc. Formation (August 2023): South Korea’s KB Kookmin Bank merged its two Cambodian affiliates—PRASAC Microfinance Institution Plc. and Kookmin Bank Cambodia Plc.—to form KB PRASAC Bank Plc. This merger combined PRASAC’s extensive microfinance experience with Kookmin Bank Cambodia’s advanced financial innovations, resulting in a commercial bank with 192 branches across Cambodia.

- Bank SinoPac’s Acquisition of Amret MFI (January 2025): Taiwan’s Bank SinoPac Ltd. acquired an 80% stake in Cambodia’s Amret Microfinance Institution for approximately USD 550 million, with plans to acquire the remaining shares over the next two years. This strategic move aims to expand Bank SinoPac’s presence in Southeast Asia and enhance financial services in Cambodia.

These M&A activities underscore a trend of consolidation and expansion within Cambodia’s banking sector, driven by both local and international financial institutions seeking to enhance their market presence and service offerings.

Insights from Industry Expert

Amidst recent reports that banks and financial institutions (FIs) in Cambodia have seen falling revenues and rising Non-Performing Loans (NPLs) over the past months, Taiwan-based SinoPac Co Ltd’s plans to acquire Amret, one of Cambodia’s four microfinance deposit-taking institutions, has generated some interest and curiosity.

What does this mean given that Cambodia’s banking and financial market has long been perceived as ‘overly crowded’, with more than 60 commercial / restricted banks and FIs operating in the Kingdom of 16+m population, and an economy whose GDP is approximately USD 30 billion in 2023.

The following insights are courtesy of Mr. Ong Teong Hoon, an experienced banker of 47 years in the banking and finance industry, and is currently the Shareholders’ Representative of Phillip Bank Plc, the only Singapore-owned commercial bank in Cambodia. Phillip Bank is also the third largest commercial bank – by the number of branch outlets – in the Kingdom.

- The primary drivers for M&A in Cambodia’s banking and finance industry are foreign FIs seeking to establish a presence in Cambodia. This is seen as a strategic move to gain entry into a region considered the last frontier for growth.

- In terms of future trends, an increase in M&A activities involving foreign FIs can be anticipated, while the establishment of new banks is more likely to slow down due to market saturation. This is partly driven by MDIs upgrading to commercial bank status, and existing banks facing rising NPLs.

- One of the factors that could influence M&A activities in the banking and finance industry is government policy, particularly the new/upcoming policies appear to adopt a more accommodative stance towards cryptocurrency, as it may in turn encourage commercial banks to explore partnerships or acquisitions with Fintech companies in the crypto space.

- In terms of risk factors, investors should carefully scrutinize asset quality, especially re-financed assets, as re-structured loans can mask delayed NPLs. It is also crucial to evaluate operational processes and staff quality. Overall, current economic conditions make the valuation of financial institutions particularly challenging.

- For companies considering M&A in the Cambodian banking and finance industry, it is important to note that regulatory authorities appear to favor shareholders of banks and FIs to be financial institutions themselves, which might pose challenges for non-FI acquirers. New entrants must also prepare for a highly competitive market, and prioritize digitization in their operations to remain viable, as conventional banking methods are increasingly being replaced by electronic transactions. Ensuring that staff are digitally proficient is also essential to meet the demands of a modernized financial landscape.

Legal and Tax Guide: Regulatory Framework of the Mining Industry in Cambodia

The Legal and Tax Guide on Cambodia’s Mining Industry is essential for mining operators and foreign investors aiming to establish or expand operations in Cambodia. It provides a high-level overview of key topics, including:

- Current state of the mining industry.

- Government incentives and policies.

- Legal framework and regulatory updates.

- Types of mining licenses (exploration and industrial mining).

- Land use considerations.

- Applicable taxes and royalty payments.

- Environmental compliance requirements.

This guide offers critical insights to navigate Cambodia’s regulatory landscape and succeed in its growing mining sector. Read the full guide here.

This legal and tax guide is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: The Instruction on Enterprise under Tax Audit of the Special Tax Audit Unit (STAU)

On October 07, 2024, the Ministry of Economy and Finance issued Instruction No. 024 MEF.SNN on the Enterprises Under Tax Audit of the Special Tax Audit Unit (“STAU”). This instruction has specified the process of selection and removal of enterprises under STAU audits, their obligations, and the cooperation needed from relevant units to ensure efficiency and compliance. There key takeaways of this instruction are as follows:

| Key points | Descriptions |

| Selection and removal of the enterprise under the authority of STAU | Enterprises to be include under STAU:

– Obtained Gold Tax Compliance Certificates from the GDT – Deemed necessary by the GDT or its management |

| Enterprises to be removed from the STAU:

– Removal of enterprises is based on decisions from the GDT or its management. |

|

| STAU must issue official notification letters for the inclusion or removal of enterprises | |

| The obligations of the enterprises that are classified under the STAU | – File tax returns via the online E-filing system, remit tax payable, and receive other services through the Unit in charge of taxpayers.

– Other units are prohibited from auditing enterprises under STAU. |

| Cooperation with the relevant units | – The Tax Compliance Evaluation Committee shall provide STAU with lists of enterprises holding Gold Tax Compliance Certificates.

– Relevant units shall supply enterprises’ data and any cross-checked information related to enterprises under STAU for further action. |

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Legal Update: Priority Sectors for Public Private Partnership 2025-2035

On 29 November 2024, the Royal Government of Cambodia have issued a decision on the Selection of Priority Sectors for Public-Private Partnerships Projects 2025-2035 (“Decision”) selecting the following sectors:

- transportation and logistics sector (roads, bridges, ports, and logistics);

- energy sector; and

- public services sector (clean water supply and waste management).

This Decision builds upon Article 8 of the Law on Public-Private Partnerships 2021, which broadly identifies eligible sectors for PPP projects, including transportation, energy, environmental protection, ICT, education, healthcare, and agriculture, among others. By specifically selecting transportation, energy, and public services as priority sectors, the Decision establishes a roadmap for Cambodia’s PPP initiatives over the next decade.

Highlights of the PPP Regulatory Frameworks:

Since 2021, Cambodia has implemented several laws and regulations to ensure the successful implementation of PPP projects, structured to align with international standards and best practices, including:

- The Law on Public-Private Partnerships (2021): This law provides guidelines on project identification, feasibility studies, financing, and risk allocation between the public and private partners.

- Sub-Decree No. 174 (2022): Provides standard operating procedures for project development, from feasibility studies to contract management to align with international best practices and fostering investor confidence in investing in Cambodia’s PPP landscape.

- Sub-Decree No. 234 (2024): Introduces Viability Gap Financing (VGF) to support projects with high potential but limited commercial viability, offering financial support through grants and concessional loans to reduce investment risks.

- Numerous Standard Operating Procedures (SOPs): Cambodia has introduced a wide range of SOPs and guidelines to support the implementation of these regulations, addressing various stages of PPP project development (which can be access here).

Opportunities for Investors

Cambodia’s robust regulatory framework demonstrates its commitment to fostering a conducive environment for PPP projects. It provides stability and clarity for investors to participate in long-term, impactful infrastructure initiatives. Cambodia’s focus on transportation, energy, and public services as priority sectors underscores the government’s commitment to fostering public-private collaboration for economic growth and sustainable development

Important Notice: The information presented in this article is intended solely for general informational purposes and should not be interpreted as legal advice.

This legal update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Tax Incentives for Enterprises Operating in Arts Sector

On October 31, 2024, the Ministry of Economy and Finance issued Instruction No. 026 MEF.SNN.GDT on Tax incentive for Enterprises Operating in Arts Sector. This instruction aims to extend the expired tax incentives provided by the Instruction No. 9549 dated June 4, 2019, which aimed to promote sustainability in the film sectors and other art performances. The instruction provides tax incentives as follows:

| Type | Suspension of taxes for 5 years (2024-2028) | |||

| Income Tax | Special tax on traditional performance services | 15% Withholding tax on royalties of intangible assets | 15% Withholding tax on services performed traditional artists | |

| Cambodian film production enterprises | √ | √ | ||

| Producing Cambodian traditional arts performance enterprises | √ | √ | √ | |

| Traditional Cambodian Artists | √ | |||

In order to receive these tax incentives, enterprises operating in the above sector must fulfill their obligations and comply with all other tax obligations.

The Ministry of Economy and Finance expects that all enterprises above comply and implement the guidelines diligently and effectively.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Legal Update: Encouraging Khmer Riel Currency Bank Accounts for Registered Businesses

On 01 November 2024, the National Bank of Cambodia (“NBC”) and the Ministry of Commerce (“MOC”) issued a Notification on The Opening of Khmer Riel Currency Bank Accounts for All Registered Businesses in the Kingdom of Cambodia (“Notification”). This Notification aims to encourage the use of Khmer Riel currency, and support financial stability aligned with the Royal Government’s policy frameworks.

Key Implications:

- For Banks and Financial Institutions: The NBC and MOC request that banks and financial institutions facilitate the opening of local currency bank accounts (KHR) for all registered businesses in Cambodia.

- For Registered Businesses in Cambodia: are encouraged to open KHR bank accounts, to promote the use of local currency in transactions, supporting economic benefits including price stability, reduced dollarization costs, export support, and the preservation of international reserves.

Comment:

Presently, as part of initial business registration requirements, there is no strict obligation for newly registered legal entities to open KHR bank accounts. However, such accounts are mandatory for registered legal entities seeking VAT refunds, as the General Department of Taxation processes refunds exclusively through KHR bank accounts.

This legal update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Tax Obligations Applicable to the Supply of Goods with Promotional Goods or Rewards by Domestic Enterprises Supplying Goods

On October 10, 2024, the Ministry of Economy and Finance issued Instruction No. 025 MEF.SNN on tax obligations of domestic enterprises supplying goods when offering promotional goods or rewards through sales promotion strategies. The key points are:

1. The provision of promotional goods or rewards in the form of inventory for sale:

- These are considered taxable supplies.

- Enterprises producing or importing goods subject to special tax or public lighting tax must pay the appropriate taxes based on market value.

- VAT, prepayment of income tax, and income tax apply at the cost of the goods.

2. The provision of promotional goods or rewards that are not part of the inventory for sale or rewards other than goods:

- These are not subject to VAT, prepayment of income tax, or tax on income.

- VAT paid on these goods cannot be claimed as input credit but is deductible as an expense for income tax purposes.

3. Deductible expenses:

- Expenses for promotional goods or rewards are deductible for income tax, provided they are clearly recorded and properly documented.

4. Other obligations of enterprises:

- Enterprises must establish clear internal policies for promotions, apply them consistently to customers, and publicly announce them.

- For monthly tax filing purposes, a monthly Tax Sale Voucher form no. 1 to 3 must be prepared, including details of promotional goods or rewards, and submitted via e-Filing.

The Ministry of Economy and Finance expects all enterprises to comply with these guidelines effectively.

Summary – Appendix of the instruction no. 025 MEF.SNN, dated 10 October 2024, as followings:

- “ST” refers to Special Tax

- “PLT” refers to Public Lighting Tax

- “VAT” refers to Value-Added Tax

- “PToI” refers to Prepayment of Tax on Income

| Promotional goods or rewards in the form of inventory goods/ non-inventory goods for sales | |||||||

| Example | Type of supply | Type of goods | ST (3% – 45%) | PLT (5%) | VAT (10%) | PToI (1%) | |

|

1 |

Enterprise A – Manufacturer (locally produced) of beer and non-alcoholic beverages | Inventory – Beer (Sell & Promotion) |

√ |

√ | √ |

√ |

|

| Inventory – Soft drink (Sell & Promotion) |

√ |

n/a | √ |

√ |

|||

|

2 |

Inventory – Beer (Sell & Promotion) |

√ |

√ | √ |

√ |

||

| Inventory – Soft drink (Sell & Promotion) |

√ |

n/a | √ |

√ |

|||

| Non-inventory – Prize (Car, Motorcycle, Hat, Cash) | n/a

(Note: these are non-inventory goods as well as not considered as a taxable supply of goods and are allowed as deductible for ToI purposes.) |

||||||

|

3 |

Enterprise B – Importer of beer and non-alcoholic beverages | Inventory – Beer and Soda (Sell & Promotion) |

n/a |

√ |

√ |

√ |

|

| Non-inventory – Promotion (Umbrella) | n/a

(Note: this is non-inventory goods as well as not considered as a taxable supply of goods and is allowed as deductible for ToI purposes.) |

||||||

|

4 |

Enterprise C – Supplying electronic equipment | Inventory – Air Conditioner (Sell) |

n/a |

n/a | √ |

√ |

|

| Inventory – Electric Kettle (Sell and Promotion) |

n/a |

n/a | √ |

√ |

|||

| Non-inventory – Promotion (T-shirt) | n/a

(Note: this is non-inventory goods as well as not considered as a taxable supply of goods.) |

||||||

| 5 | Enterprise D – Car dealership | Inventory – Car (Sell) |

n/a |

n/a | √ |

√ |

|

| Non-inventory – Promotion (Motorcycle, Gasoline Voucher, Leisure Travel Ticket) | n/a

(Note: this is non-inventory goods as well as not considered as a taxable supply of goods and is allowed as deductible for ToI purposes.) |

||||||

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Extended Deadline on Incentives for Voluntary Adjustments of Tax Returns

On 10 October 2024, the Ministry of Economy and Finance issued an amendment to Prakas No. 071, which modifies the provisions concerning voluntary adjustments of tax returns. This amendment introduces critical changes, particularly regarding the deadline for penalty exemptions and conditions during tax audits. Below is a detailed comparison between the old and new provisions, along with key points taxpayers need to take note of:

| PROVISION | PREVIOUS PRAKAS | AMENDED PRAKAS |

| Extension of exemption deadline | End of June 2024 | End of June 2025 |

| Eligible transactions for exemptions | Transactions before January 2024 | Transactions before August 2024 |

| Exemption of administrative penalties for corrections made during tax audits | Only if correction is made before audit findings | No changes |

| Administrative penalties if the corrections are made after audit findings | 10% additional tax, 1.5% late interest | No Changes |

| Credit for payments after the audit findings | Payments will be credited against the audit result | No Changes |

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Tax Incentives for Enterprises in the Tourism Sector in Siem Reap Province

On October 10, 2024, the Ministry of Economy and Finance issued a Prakas extending tax incentives for tourism businesses in Siem Reap province through June 2025. This follows the expiration of the previous Prakas No. 119, dated February 08, 2024 which provided tax incentives to tourism enterprises in multiple provinces. Unlike the previous incentives that applied to multiple provinces, the 2024 Prakas exclusively focuses on Siem Reap’s tourism sector.

| ASPECT | EXPIRED PRAKAS (2023) | NEW PRAKAS (2024) |

| Effective Period | October 2023 – June 2024 | July 2024 – June 2025 |

| Geographic Scope | multiple provinces (Siem Reap, Phnom Penh, Preah Sihanouk, Kep, Kampot) | Siem Reap Province only |

| Monthly Tax Exemptions | Exemption from all monthly taxes except VAT & accommodation tax | Same exemption from July 2024 – June 2025 |

| Annual Income Tax | Exempt for 2023, credit toward 2024 | Exempt for 2024, credit toward 2025 |

| Audit Exemptions | No audits for 2020-2023 | No audits for 2024 |

Government Policy Supports:

This Prakas aligns with the Royal Government’s ongoing efforts to revive Siem Reap’s tourism sector. On the 1st Anniversary of the 7th Legislature of the National Assembly, Prime Minister Hun Manet reaffirmed the government’s commitment by announcing an extension of the tax exemption for tourism businesses in Siem Reap. The exemption, now extended for another year, will remain in effect until the end of June 2025, providing continued relief to businesses as part of the broader recovery plan.

What’s New for 2024:

- Focus on Siem Reap: The new Prakas is dedicated solely to tourism enterprises in Siem Reap.

- Extended Relief: Tax exemptions continue through June 2025.

- No Audits: Tourism businesses in Siem Reap will not face audits for the 2024 fiscal year.

What to Do Next: Siem Reap-based tourism businesses should ensure compliance with the new Prakas and leverage these continued incentives to support their operations in 2024 and 2025.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Extension and Addition of Tax Incentives for Real Estate Sector

On October 9, 2024, the Ministry of Economy and Finance issued Notification No. 014 on the Extension and Addition of Tax Incentives for Real Estate Sector (“Notification No. 14”), introducing several tax incentives for property owners and housing developers to reduce their tax burden. These measures are based on Notification No. 001 dated January 4, 2024 and the Royal Government’s Special Statement on its achievements dated August 22, 2024, with approval from Samdach Moha Borvor Thipadei Prime Minister on September 26, 2024. The updated incentives will be effective through the end of 2025.

The announcement includes the following key tax incentives for the real estate sector:

| Tax Incentive | Details | Conditions | Validity |

| Stamp Tax on Transfer of Ownership or Possession of Real Estate

|

No stamp tax for housing transfers in Borey developments valued at $70,000 or less.

|

Must provide accurate sale contracts based on market value | Until the end of 2025 |

| $70,000 deduction from the tax base for properties the value over $70,000 in registered Borey housing development projects.

|

|||

| Capital Gains Tax | Capital gains tax on real estate owned by individuals are postponed.

|

None | Until the end of 2025 |

| Capital gains tax applies to transfer leases, investment assets, goodwill, intellectual property, and foreign currency will apply from 2025.

|

None | From 2025 onwards | |

| Property Tax | Agricultural land used for cultivation is exempt from property tax | No extra permits needed | Ongoing, based on usage |

| Residential land being used for agricultural purposes may qualify for exemption.

|

Requires certification from the local authority. | ||

| No reassessment for incorrect filings before 2025; penalties are waived for unregistered properties until mid-2025

|

None | Until June-2025 | |

| Unused Land Tax Suspension | Unused land tax is postponed | None | Until the end of 2024 |

| From 2025, exemptions will apply for land used in agriculture, economic activities, etc.

|

Land must meet exemption criteria set out for 2025. | From 2025 onwards |

The tax exemptions, reliefs, and suspensions in Notification No. 014 do not apply retroactively to taxes or penalties already paid. Property owners and developers should take note of these updates, which provide significant tax reliefs through the end of 2025.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Instruction on Procedures to Apply for Permanent Dissolution of Businesses

On September 17, 2024, the General Department of Taxation issued an important Instruction outlining the procedures and obligations for taxpayers seeking to apply for the permanent dissolution of a business, in accordance with Article 203 of the Law on Taxation. The process can be summarized as follows:

1. Notification Requirement

Taxpayers must notify the tax administration within 15 days after the permanent dissolution of the business, following procedures outlined in Article 203 of the Law on Taxation.

2. Application Process

- Taxpayers can apply for dissolution through an online platform, the GDT e-Administration app, or by submitting Form 103 in person at the tax office.

- The application must include required documents such as a notification letter for dissolution and proof of stamp duty payment (1,000,000 riels).

3. Final Tax Filing

- Before applying, the taxpayer must close their accounting books and submit all monthly and annual tax returns up to the date of dissolution.

- Once the application is accepted, taxpayers are no longer required to submit monthly or annual tax returns. All tax services, including invoicing, tax certificates, and tax incentives, will be suspended, except for settling outstanding tax debts.

4. Tax Audit and Inspection

The tax administration may conduct a tax audit as part of the dissolution process. Taxpayers must prepare necessary documents and fully cooperate with the audit process to expedite dissolution.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Legal Update: Establishment of the National Committee on Trade Remedies

On August 27, 2024, the Royal Government of Cambodia issued a Sub-Decree establishing the National Committee on Trade Remedies (“NCTR”). This Sub-Decree introduces a new regulatory body intended to oversee and ensure the effective implementation of Cambodia’s trade protection measures under the Law on Trade Remedies, which covers anti-dumping, subsidies, countervailing measures, and safeguards related to trade in Cambodia. The creation of the NCTR is a significant step forward in aligning Cambodia’s trade policy with international standards, particularly those set by the World Trade Organization (“WTO”).

I. National Committee on Trade Remedies

The establishment of the NCTR, introduced by the new Sub-Decree, is a proactive measure by the Cambodian government to strengthen the country’s trade remedies framework. The primary objective of the NCTR, as outlined in the Law on Trade Remedies, is to protect domestic industries, particularly emerging sectors, from unfair trade practices such as dumping, subsidized imports, and import surges that may cause injury or threaten the viability of these industries.

1. Key Responsibility of the NCTR:

- Enforcing the Legal Frameworks: The NCTR is responsible for implementing the legal procedures established under the Law on Trade Remedies and related international agreements, including WTO agreements to which Cambodia is a party. Additionally, it has the authority to develop legal procedures for safeguarding confidential information submitted during investigations and to prepare formal legal documents for judicial review in cases where an NCTR decision is appealed.

- Advisory Roles: The NCTR shall provide recommendations on proposed amendments to the Law on Trade Remedies and addresses regulatory conflicts between governmental agencies. It is also tasked with reviewing and offering expert advice to ensure the effective application of the Law on Trade Remedies.

- Collaboration and Supports: The NCTR shall collaborate with other member states and provides guidance, monitoring, and assistance to all stakeholders in the collection of information and other activities related to disputes on trade remedies to which Cambodia is involved.

2. Composition and Governance

- Structure: The NCTR is composed of 13 members, chaired by the Minister of Commerce with a permanent Vice Chairperson and 3 Vice Chairpersons, and may be adjusted as deemed necessary. The precise makeup of the committee is expected to be covered in a forthcoming Decision by the Royal Government.

- Meetings and Governance: The NCTR will meet at least twice annually and hold special sessions when necessary. External experts may be invited to assist in specialized trade issues. The Ministry of Commerce’s Information and Legal Notification Department will serve as the secretariat, providing administrative and logistical support.

- Budget and Funding: The NCTR will be funded through the separate national budget, with additional revenues generated from penalties and public services related to trade remedies, to be regulated by a Joint Prakas between the Ministry of Commerce and the Ministry of Economy and Finance.

II. Specific POWERS OF THE NCTR Under the LAW ON Trade Remedies

While the new Sub-Decree outlines the general responsibilities for the functioning of the NCTR, NCTR’s specific powers are detailed in the earlier Law on Trade Remedies, which covers the following:

1. Anti-Dumping Measures:

Anti-dumping measures are designed to protect domestic industries from imports sold at unfairly low prices, referred to as “dumping.” Dumping occurs when foreign producers sell goods in the domestic market at prices lower than their normal value, typically below the price charged in their home market or below production cost. This can harm domestic industries by undercutting local prices and creating unfair competition. A product may be subject to investigation if it is being introduced into the Cambodian market at a price lower than its normal value in the country of origin.

The NCTR is empowered to:

- Determine normal value and export prices for products under investigation.

- Initiate and conduct anti-dumping investigations.

- Impose provisional and definitive anti-dumping duties.

- Review duties periodically to assess whether they should be continued or amended.

2. Subsidies and Countervailing Measures:

Subsidies provided by foreign governments to their exporters can distort trade by giving those exporters an unfair competitive advantage. Countervailing measures are duties imposed to offset the benefits of such subsidies, leveling the playing field for domestic producers.

The NCTR shall primarily be responsible for investigating and imposing countervailing duties to counterbalance any unfair advantages gained by foreign companies, despite the fact that subsidies and countervailing measures are to be further defined by a forthcoming Sub-Decree.

3. Safeguard Measures:

Safeguard measures are temporary protections imposed when a sudden surge in imports causes, or threatens to cause, serious injury to domestic industries, even if there is no unfair practice like dumping or subsidies. Safeguards are designed to give domestic industries time to adjust to increased competition.

The NCTR shall be responsible for:

- Assessing whether increased imports are causing or threatening serious injury to domestic industries.

- Initiating and conducting safeguard investigations.

- Imposing safeguard measures such as tariffs or quotas to protect domestic industries.

- Reviewing safeguard measures periodically to determine whether they should be extended or modified.

Judicial Review of NCTR’s decision and Appeal Process

The Law on Trade Remedies provides for judicial review of NCTR decisions to ensure compliance with legal standards. Parties affected by an investigation or remedy may appeal the NCTR’s decision to the courts, with such appeals required to be filed within 30 days of the determination’s publication in the NCTR’s official bulletin. During the appeal process, the Customs Authority may suspend the collection of duties if the importer provides security, such as a cash deposit or bond, pending the final court ruling.

Comments

The establishment of the NCTR is a critical step in enhancing Cambodia’s trade defense mechanisms, ensuring that the country is equipped to address unfair trade practices in accordance with WTO obligations. As Cambodia continues to integrate into the global trade system, the NCTR’s role will be vital in safeguarding domestic industries from harmful trade practices while promoting a rules-based international trading environment. With the forthcoming regulations expected to provide further clarity on its operations, the NCTR will serve as a cornerstone of Cambodia’s trade policy for years to come.

This legal update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Withholding Tax and Specific Tax Relief for Airline Companies

An Instruction on tax relief has been issued by the Ministry of Economy and Finance of Cambodia. The instruction reduces withholding tax from 14% to 10% on aircraft leasing for domestic airline operators and the special tax on air transportation services from 10% to 5% for both domestic and foreign airline operators. This initiative, backed by the Prime Minister, aims to ease the tax burden on airlines leasing aircraft from foreign entities and reduce air travel costs air passengers. This measure is effective from June 1, 2024, to May 31, 2027.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Request for Exemption of VAT on E-Commerce Applicable to Certain Financial Services

On August 22, 2024, the General Department of Taxation (GDT) issued a response letter to the request submitted by the Association of Banks in Cambodia and the Cambodia Microfinance Association concerning the VAT reverse charge exemption on specific e-commerce financial services. The exempted services include:

- Education and training expenses, including e-learning materials.

- Overseas legal services.

- Independent director fees.

- Risk assessment services by agencies like MOODY’s, S&P, and FITCH.

- Monthly fees related to payment transactions from foreign correspondent banks.

- Overseas money transfer fees.

- Expenses for obtaining overseas loans, including interest and service fees.

- Money transfer services via SWIFT or BOTTOMLINE (excluding annual fees for system usage), etc.

This is a positive move by the government to limit the overly broad scope of the VAT reverse charge applicable to e-commerce transactions for taxpayers in the financial industry during this tough period, as they engage in VAT-exempt business activities, and cannot claim deductible VAT inputs.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Instruction on the Implementation of Tax Obligations on Rental of Real Estate

In lease contracts, the landlord often grants the tenant a period for construction or renovation without charging rent (“grace period”). However, such arrangements are frequently scrutinized by the tax administration, which treats the grace period as taxable income and imposes VAT even though the property is not generating revenue during this time for either party. The situation may be even more complex in related-party transactions. Many argue that treating such grace periods as free disposal or gifts to third parties seems to contradict the intent of the tax law and basic principles of contract law.

This approach has shifted with the issuance of Instruction No. 33000 dated 18 September 2024, according to which the General Department of Taxation (“GDT”) now allows a grace period of up to 10% of the lease term without tax implications (namely income tax and VAT) for both parties. If the grace period exceeds 10%, prior approval from the GDT may be required. This business-friendly move represents a big win for both the government and taxpayers.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Legal Update: Launching of Standard QR Code for Verification on the Certificate of Incorporation

On 7 August 2024, the Ministry of Commerce (“MOC”) and the Ministry of Post and Telecommunications (“MPTC”) jointly issued a Notification on the Launching of Standard QR Code for Verification via “verify.gov.kh” on the “Certificate of Incorporation” (“Notification”). This Notification aims to align with goals under the Cambodian government digital policies and the Sub-decree No. 52 issued in the previous year on the launching of “verify.gov.kh” portal (“Portal”).

The key highlights of this Notification are as follows:

- Standard QR Code on COI: A standard QR code will be embedded on the Certificate of Incorporation (“COI”), issued by the MOC. By scanning that QR code with a smart-device camera, such COI can be quickly verified to ensure its genuineness with high security and accuracy.

- Elimination of Legalized Paper Copies: The COI with the standard QR code can be officially used, by no longer requiring its legalized copies in paper form (as practically made by businesses and general publics at the capital-provincial hall).

It is also important to note that, in accordance with the related Sub-decree No. 52, the verification process conducted through the Portal does not require the payment of public service fees.

This development marks a significant step forward in the Cambodian government’s efforts to streamline business registration processes, enhance document security, and reduce administrative burdens on businesses.

This legal update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Legal Update: Registration of Private Parts of Co-owned Buildings

On 19 July, 2024 the Ministry of Land Management, Urban Planning and Construction (“MLMUPC”) issued a Prakas on Rules and Procedures on Registration of Private Parts of Co-owned buildings (“Prakas”). The key implication of this Prakas is to provide a legal mechanism for registering legal ownership rights for the respective owners of co-owned buildings constructed before 19 December 1997.

The key highlights of this Prakas are as follows:

1. Legal Framework:

a. Scope of Application: This Prakas applies to all co-owned buildings that were constructed before 19 December 1997.

b. Key Definitions of this Prakas

-

- Private Parts: refers to sections of co-owned buildings designated for exclusive private ownership, use, and management.

- Legal Representative: refers to the company board of directors, chief executive officer, company director, or director of a sole proprietorship whose name is registered in the Articles of Incorporation; or a representative agent of a foreign entity created under foreign laws; or managers or chief executive officers whose names are listed in the articles or memorandum of organization; or representatives of an association, leaders of political Parties, or other natural persons whose names are listed in the Prakas or Provisions on Registration or Recognition of Legal Entities.

- Co-owned Buildings: refers to buildings or constructions that have multiple owner residents. Co-owned buildings include sections that are exclusively owned by co-owners and shared spaces for collective use by all co-owners. Examples of these types of co-owned buildings include villas, semi-detached villas, multi-story flats, condominiums, and other types of housing with shared infrastructure.

c. Applicable Regulations: Registration of private parts of co-owned building constructed before 19 December 1997, shall be through:

-

- Systematic land-registration procedures: by implementing the same legal procedures as provided in:

- Sub-decree No. 46, dated 31 May 2002, on Procedures to Establish Cadastral Index Map and Land Register; and

- Sub-decree No. 122, dated 19 June 2016, on Amendments of Article 6,7 & 11 of Sub-decree No. 46 on Procedures to Establish Cadastral Index Map and Land Register and relevant regulations; or

- Sporadic land-registration procedures: by supplementing the legal procedures (in case systematic land registration was missed) as provided in:

- Sub-decree No. 48, dated 31 May 2002, on Sporadic Land Registration; and Sub-decree No. 121, dated 9 June 2016, on Amendments of Article 9 & 13 of Sub-decree No. 48 on Sporadic Land Registration.

- Systematic land-registration procedures: by implementing the same legal procedures as provided in:

2. Registration Requirements:

a. Application Documents: The application form shall be made in Khmer language, and the supporting documents is not required to be certified by the local authorities.

b. Execution Formality: The execution requirements vary depending on whether the applicant is an individual, sole proprietor, partnership, company, or other legal entity.

| Individual | Sole Proprietorship | Partnership and Company | Other Legal Entities |

| Right-thumb fingerprint or signature directly on the registration form by the applicant.

|

i. Right-thumb fingerprint or signature;

ii. Full name of the legal representative; and iii. Enterprise’s official stamp;

|

i. Right-thumb fingerprint or signature;

ii. Full name of the legal representative; iii. Enterprise’s official stamp; and iv. Power of attorney from the shareholders or board of directors, as specified in the memorandum and articles of association, shall also be attached. |

i. Right-thumb fingerprint or signature,

ii. Full name of the legal representative, iii. Enterprise’s official stamp. iv. Power of attorney from the designated decision-maker of the legal entity shall be attached. |

3. Conditions for granting titles: Owners are required to submit the original title over housing, or other documents specifying the legal possessory rights, in exchange for a certificate of title over the private part of the co-owned buildings. The original title over housing, or other documents specifying the legal possessory rights, will be rendered null and void and retained by the cadastral administration.

4. Registration Fee: Registration of the private parts of the co-owned buildings will require a registration fee, which is to be determined by the Ministry of Economy and Finance and MLMUPC.

This legal update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update: Guidelines on the Implementation of Sub-decree on Tax Incentives for the Development of Informal Economy

Following the issuance of Instruction No. 18412 on the Implementation of Tax Incentives for Micro, Small, and Medium Enterprises for the Development of the Informal Economy, the Ministry of Economy and Finance issued Prakas on Guidelines for the Implementation of the Sub-Decree on Tax Incentives for the Development of the Informal Economy on June 19, 2024. This Prakas provides the definitions of Micro, Small, and Medium Enterprises (“MSMEs”), which mostly align with Prakas No. 009 on the Classification of Taxpayers According to the Self-Assessment Regime dated January 12, 2021. As a result, MSMEs operating in four priority sectors, namely (1) wholesale, retail, and repair services, (2) accommodation and food services, (3) handicrafts, and (4) agricultural cooperatives, may be entitled to several tax incentives if they voluntarily register with the tax administration.

Definition of Micro, Small, and Medium Enterprises:

| Classification criteria | Micro Enterprise | Small Enterprise | Medium Enterprise |

| Turnover in million riels | > 250 | ||

| – Agricultural cooperative | N/A | 250 – 1000 | 1000 – 4000 |

| – Accommodation, and food services, wholesale, retail, and repair | 250 – 1000 | 1000 – 6000 | |

| – Handicraft | 250 – 1600 | 1600 – 8000 | |

| Assets worth in million riels | > 200 | ||

| – Agricultural cooperative, | N/A | 200 – 1000 | 1000 – 2000 |

| – Accommodation, and food services, wholesale, retail, and repair | 200 – 1000 | 1000 – 2000 | |

| – Handicraft | 200 – 2000 | 2000 – 4000 | |

| Employee | 1-4 | 5-49 | 50-199 |

| Form | Sole Proprietorship and Partnership | Sole Proprietorship and Partnership | Legal Person, Representative Office |

The Tax Incentives are Granted as Follows:

| Report annual turnover | Update corporate information changes | Keep accounting record | Monthly and annual tax filing | |

| Micro Enterprise | ✔ | ✔ | n/a | n/a |

| Small Enterprise | n/a | ✔ | ✔ | ✔ |

| Medium Enterprise | n/a | ✔ | ✔ | ✔ |

- Exemption of patent tax upon registration, and the subsequent 2 years

It is important to note that unilateral registrations done by the tax administration, and failure to register within 15 days following the reception of a second invitation to register are not considered voluntary tax registration. Additionally, Micro, Small, and Medium Enterprises (MSMEs) must comply with certain key obligations, detailed in the ‘Tax Update: New Instructions on Tax Incentives for MSMEs.”

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Legal Update: Penalty Exemptions for Real Estate Developer and Condominiums

Pursuant to the announcement made at the 19th Royal Government-Private Sector Forum on 13 November 2023, and in alignment with the recommendations by the Prime Minister of Cambodia, Samdach Thipadei HUN Manet, on 1 July 2024, the Real Estate Business & Pawnshop Regulator issued a critical new Notification on Obligations of Real Estate Developers and Condominiums (“Notification”). This Notification introduces penalty exemptions for real estate developers specifically developers of borey and condo for a certain period, aiming to bolster the construction and real estate sectors.

The key highlights of this Notification are as follows:

- Exemption from Fines and Penalties: Effective from 01 July 2024, developers of borey and condos may enjoy a one-year exemption from fines and penalties, provided they comply with the obligations imposed under Prakas No. 047. This grace period extends until 01 July 2025, or longer if the government decides to extend it, providing a window of opportunity for developers to meet regulatory requirements without financial repercussions.

- Implementation of Prakas No. 047: To be eligible for this exemption, real estate developers must adhere to the obligations imposed under Prakas No. 047 on the Rule and Procedures on Licensing and Permits for Real Estate Development Business, dated 26 September 2023 which primarily covers the rules and procedures for licensing applications for real estate development businesses as well as the compliance obligations of real estate developers.

- Mandatory Licensing Compliance: real estate developers that have not yet obtained licenses are required to apply for licenses within this exemption period. Failure to secure the appropriate development licenses before the expiration of the exemption period will result in the reinstatement of fines and penalties.

Implications for the Real Estate Sector:

This Notification represents a strategic move by the Cambodian government to stimulate growth and compliance within the real estate sector. By offering temporary relief from fines and penalties, real estate developers are incentivized to regularize their operations and align with regulatory standards.

Real estate developers are encouraged to take full advantage of this exemption period to secure the necessary licenses and ensure compliance with Prakas No. 047. The government’s supportive stance underscores its commitment to creating a conducive environment for sustainable development and investment in the real estate sector.

This legal update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Tax Update (Prakas No. 313 MEF. PrK. PD): Tax Incentives for the Expansion of Qualified Investment Projects (EQIPs)

The Ministry of Economy and Finance (MEF) of Cambodia has recently issued new procedures to provide income tax incentives for Expanded Qualified Investment Projects (EQIPs) in the Kingdom under Prakas No. 313 MEF. PrK. PD (Dated May 10, 2024). This Prakas aims to provide additional definitions, clarifications and conditions for obtaining tax incentives for the EQIP to boost commercial growth and support industries benefiting the nation, under various circumstances as follows:

(1) Restatement of conditions for income tax incentives under Article 16 of Sub-Decree no. 139 on Investment

An expansion of QIP-EQIP may be entitled to income tax incentives in the following situations:

- Expansion of the existing means of production;

- Expansion via production line diversification within the same lines; and

- Expansion via the use of new modern technologies which enhance productivity or protect the environment.

(2) Restatement of definitions of terms provided in Sub-Decree no. 139

Besides the restatement of some definitions of the Sub-Decree no. 139, such as investment capital, QIP expansion capital, and total investment capital, the Prakas defines the term “QIP’s initially registered investment capital” as “the investment capital effectively invested before the injection of QIP’s expansion capital taking into account the historical value of the assets invested. Invested assets include buildings and structures of the building, components of buildings, computers, electronic information systems, electronic devices, data storage equipment, vehicles, trucks, furniture and office equipment, and other long-term assets.”

This new definition is much narrower than the undefined term in the Sub-Decree, as “QIP’s initially registered investment capital” may be self-explanatory and should mean registered investment capital when the QIP was initially approved by the CDC. Therefore, using the terms “effectively invested” and “taking into account the historical value of the assets invested” would greatly impact the calculation of the income tax exemption.

(3) Restatement of the formula provided in the Sub-Decree no. 139

IETOI = TTI x (EC/TIC)

IETOI = Income that shall be exempted from Tax on Income

TTI = Total taxable income

EC = the QIP’s expansion capital which shall be incentivized

TIC = Total Investment Capital (IRC + EC)

IRIC = QIP’s initially registered investment capital

The example provided in the Prakas:

In case the QIP’s expansion capital is 100%

Enterprise A is a QIP with an initial registered investment capital (investment capital before requesting expansion) totaling 22 billion riels. At the beginning of 2022, Enterprise A proposed to expand its investment activities on existing production with the approval from the CDC an investment capital of 20 billion Riels and to be exempted from income tax for 3 years. The enterprise used 100% of its capital to expand the QIP during the tax year 2022 (100% effectively invested) and received total taxable income from the QIP and EQIP for 8 billion riels.

The calculation of the part of income entitled to tax exemption for the year 2022 of Enterprise A is as follows:

TIC = 22 billion + 20 billion = 42 billion

EC rate = 20 billion / 42 billion = 48%

IETOI = 8 Billion x 48% = 3,840 million riels

The proportion of income entitled to the Income Tax Exemption Incentive for EQIP for the tax year 2022 is 3,840 million riels. Since the enterprise used 100% in 2022 (effectively invested), its EC rate of 48% must apply for 2023 and 2024, the same as in 2022. Conversely, if the EC is not 100% effectively invested in the first year, the pro rata formula would apply, meaning that different EC rates may apply throughout the incentive period depending on the EC effectively invested in each year (as outlined in example 2 of the Prakas).

What would the EC rate be if the definition of “QIP’s initially registered investment capital” were self-explanatory?

Assuming that Enterprise A is registered as a QIP in 2014 with an initially registered investment capital of 10 billion riels approved by the CDC. After 9 years of operation, its investment capital reaches 22 billion riels (investment capital before requesting expansion). If we follow the example above with 20 billion EC in 2022, the final figure would be as follows:

TIC = 10 billion + 20 billion = 30 billion

EC rate = 20 billion / 30 billion = 66%

IETOI = 8 Billion x 66% = 5,280 million riels

(4) Restatement of incentive on prepayment of TOI and minimum tax

The prepayment of TOI for the QIP and EQIP shall be exempt based on the proportion of the QIP’s EC rate for the period of income tax exemption of the expansion project, whereas minimum tax is exempt on the condition of having an independent audit report.

(5) Withdrawal of tax incentives

The tax incentives may be withdrawn from the EQIP if (1) the EC is not effectively invested in the EQIP following the plan of expansion, (2) the EC is not injected before the expiry of tax exemption status of EQIP, and (3) the EQIP fails to comply the tax laws and regulations in force.

This tax update is brought to you by Davies SM Attorneys-at-law. For more information and guidance, contact our partners and explore the Library of Laws section on Aquarii’s online platform to stay informed on business and investment laws in Cambodia.

Source: Prakas No. 313 MEF. PrK. PD (Dated May 10, 2024), Translated by Davies SM

Law on Investment: Qualified Investment Projects (QIPs)

The Law on Investment (LoI) promulgated on October 15, 2021 in Cambodia, aims to establish an open, transparent, and predictable legal framework to attract and promote quality, effective and efficient investments by Cambodian nationals or foreigners in the Kingdom of Cambodia. The LoI applies to “Qualified Investment Projects” (QIPs), “Expanded Qualified Investment Projects” (EQIPs) and “Guaranteed Investment Projects” (GIPs) registered with the Council for the Development of Cambodia (CDC) or Municipal Provincial Investment Sub- Committees (PMIS).

In this article, we provide the overview of the QIPs and their comprehensive incentives.

1. Overview

Qualified Investment Projects (QIPs) are specific types of investment projects that meet specific criteria set by the Cambodian government. This status provides various incentives and benefits to encourage investment in the country. CDC is the primary governmental body responsible for approving and overseeing QIPs. To qualify, projects must be registered with CDC or PMIS and receive a Registration Certificate (RC).

RC is a certificate that recognizes the investment project with a barcode, identification number, QR code, or other technology containing preliminary data related to the registered investment project for the benefit of other registrations and the implementation of the Investment Project.

2. Procedure

Under the LoI, QIPs are issued to projects, not to investors or investing enterprises. Investors or investment companies wishing to implement a QIP and obtain QIP status, and be entitled to some or all available investment incentives, must establish and register as a Limited Liability Company (i.e., Private Limited Company) and submit a written application to the CDC or PMIS, or submit the Investment Project Application via an online portal.

The investment application is reviewed and decided via a One-Stop-Service mechanism, conducted by representatives of the relevant ministries or institutions seconded to the CDC, based on assignments and appointments from the heads of the relevant ministries and institutions under the coordination of the CDC.

The CDC will issue the RC within 20 working days upon receipt of the application if the proposed investment project is not on the Negative List. The date of obtaining the RC is the commencement date of the QIP. However, the RC does not exempt the project from receiving permits or approvals from relevant ministries or institutions as required by law and regulations.

All investment projects are subject to monitoring and inspection through the One-Stop-Service mechanism coordinated by the CDC to ensure compliance with the laws and requirements for obtaining the RC. The investors or investment companies carrying out an investment project must provide a report on the project’s implementation according to a schedule set by the CDC. The detailed format of the report template will be determined by the CDC’s guidelines. Providing the report on the implementation of the investment project does not exempt it from on-site inspections if the CDC deems necessary or if there is any complaint from persons claiming to be affected by the implementation of the investment project.

3. Types of QIPs

There are three types of QIPs available:

- Export QIP: a QIP that sells or transfers any proportion of its products to purchasers or recipients outside the Kingdom of Cambodia.

- Supporting Industry QIP: a QIP in which any proportion of its products is supplied to export industries.

- Domestically Oriented QIP: QIP that does not export.

4. Incentives

Under the LoI (Chapter 6), 19 investment sectors (listed in Article 24 of the LoI) – if they are not on the Negative List (still to be defined in a Sub-Decree) – shall receive investment incentives after obtaining a RC certifying their QIP status. The incentivized sectors are:

- High-tech industries involving innovation or research and development;

- Innovative or highly competitive new industries or manufacturing with high added value;

- Industries supplying regional and global production chains;

- Industries supporting agriculture, tourism, manufacturing, regional and global production chains and supply chains;

- Electrical and electronic industries;

- Spare parts, assembly and installation industries;

- Mechanical and machinery industries;

- Agriculture, agro-industry, agro-processing industry and food processing industries serving the domestic market or export;

- Small and medium-sized enterprises in priority sectors and small and medium-sized enterprise cluster development, industrial parks, and science, technology and innovation parks;

- Tourism and tourism-related activities;

- Special economic zones;

- Digital industries;

- Education, vocational training and productivity promotion;

- Health;

- Physical infrastructure;

- Logistics;

- Environmental management and protection, and biodiversity conservation and the circular economy;

- Green energy, technology contributing to climate change adaptation and mitigation;

- Other sectors and investment activities not listed by the LoI deemed by the Royal Government of Cambodia to have potential for socio-economic development.

4.1. Basic Incentives

Investment activities registered as QIP are entitled to choose between 2 basic sets of incentives.

Option 1: Tax Exemption Period: An Income Tax exemption for 3 to 9 years, depending on the sector and investment activities, from the time of earning of first income. Sectors and investment activities, as well as the period of income tax exemption, shall be determined in the law on financial management and/or the LoI Sub-Decree.

After the income tax exemption period has expired, the QIP is entitled to paying income tax at a rate proportional to the total tax due as follows: 25 % for the first 2 years, 50 % for the next 2 years and 75% for the last 2 years.

Further, this option includes:

- Prepayment Tax exemption during income tax exemption period;

- Minimum Tax exemption provided that an independent audit report has been carried out; and

- Export Tax exemption, unless otherwise provided in other laws and regulations.

Option 2: Special Depreciation: The second option for basic incentives entails:

- Deduction of capital expenditure through special depreciation as stated in the tax regulations in force;

- Eligibility of deducting up to 200 % of specific expenses incurred for up to 9 years. Sectors and investment activities, specific expenses, as well as the deductible period, shall be determined in the Law on Financial Management and/or the LoI Sub-Decree;

- Prepayment Tax exemption for a specific period of time based on sectors and investment activities to be determined in the Law on Financial Management and/or the LoI Sub-Decree;

- Minimum Tax exemption provided that an independent audit report has been carried out; and

- Export Tax exemption, unless otherwise provided in other laws and regulations.

In addition to the incentives of option 1 or option 2:

- Export QIP and Supporting Industry QIP are entitled to customs duty, special tax and value-added tax exemption for the import of Construction Material, Construction Equipment, Production Equipment and Production Inputs;

- Domestically Oriented QIP is entitled to customs duty, special tax and value-added tax exemption for the import of Construction Material, Construction Equipment, and Production Equipment. The incentives for Production Inputs shall be determined in the Law on Financial Management and/or the LoI Sub-Decree.

4.2. Additional Incentives

In addition to the basic incentives, investment activities registered as QIP receive additional incentives, which are very much focused on advancing local production, R&D and improving the working conditions of local employees:

- Value-added tax exemption for the purchase of locally made Production Inputs for the implementation of the QIP.

- Deduction of 150 % from the tax base for any of the following activities:

-

- Research, development and innovation;

- Human resource development through the provision of vocational training and skills to Cambodian workers/employees;

- Construction of accommodation, food courts or canteens where reasonably priced foods are sold, nurseries and other facilities for workers/employees;

- Upgrade of machinery to serve the production line; and

- Provision of welfare for Cambodian workers/employees, such as comfortable means of transportation to commute from their homes to factories, accommodation, food courts or canteens where foods are sold at reasonable prices, nurseries and other facilities.

- Entitlement to income tax exemption for the Expansion of QIP which will be determined in the LoI Sub-Decree.

4.3. Special Incentives

In addition to basic incentives and additional incentives, this law paves the way for the government to provide special incentives to specific sectors and investment activities that have high potential to contribute to national economic development, which are identified in Financial Law for Management.

Get in touch with our team here for more information on doing business in Cambodia or explore our Library of Laws section to stay informed on business and investment laws in Cambodia.

Source:

Wastewater Management in Cambodia: 2024 Overview and Opportunities

This article provides an overview of wastewater management in Cambodia, covering the current challenges, government initiatives, international collaborations, and ongoing developments. Additionally, it highlights business opportunities for both foreign and local investors. For further detailed market insights, please refer to our comprehensive cross-sector business environment map here or get in touch with our expert team.

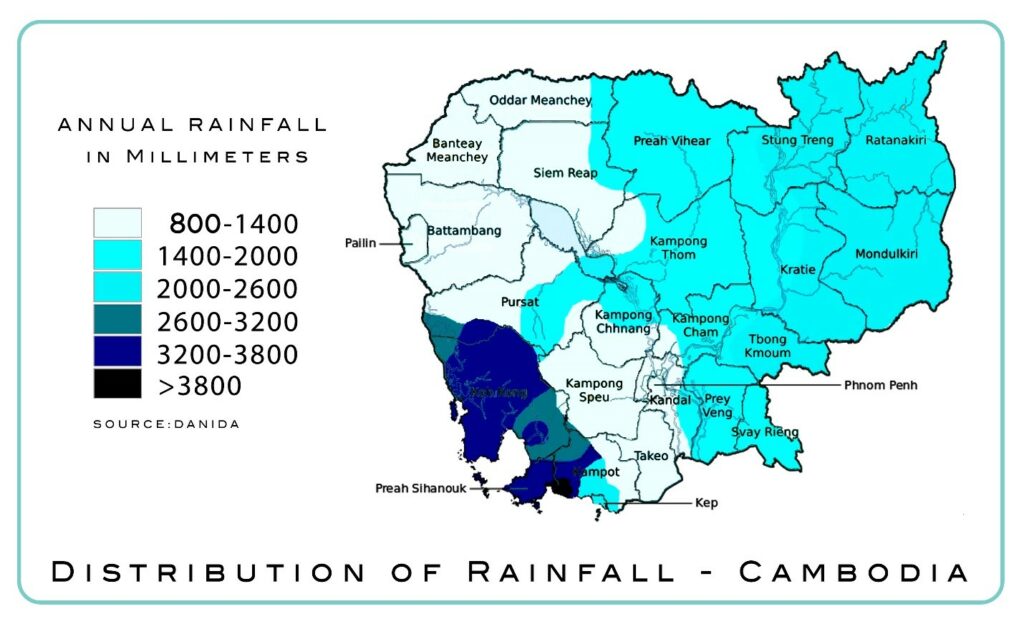

Cambodia’s economy relies heavily on its rich groundwater and surface water resources, which mostly come from the Mekong and Tonle Sap rivers. Cambodia’s annual precipitation commonly ranges from 1,400 mm to 3,800 mm, although climate change as well as industrialization are complicating water management; in the dry season, there are more water shortages, and in the rainy season, more floods.

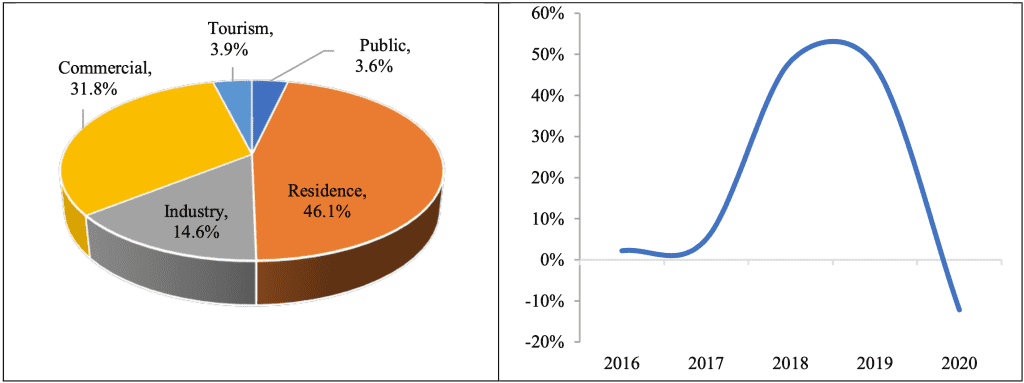

Cambodia has experienced rapid urbanization and industrialization in recent years, which, naturally, has led to more wastewater coming from residential, commercial, and industrial sources. Phnom Penh, in particular, struggles with rainy season flooding, which has a lot to do with its outdated sewage and drainage systems. Some parts are nonfunctional and some are too weak, for example, to handle the demands that are created by a growing population and more industrialization that’s been happening in the city.

Beyond sheer volumes, there is another major problem. Most discharged water isn’t undergoing proper treatment before entering main water bodies. (In fact, only a handful of cities – Phnom Penh, Siem Reap, Sihanoukville, and Battambang – have wastewater treatment facilities). This poses risks to human health and the environment. Coping with this challenge is significant for wastewater managers in Cambodia.

Recent developments signal a shift towards improved wastewater management in Cambodia. More specifically, the Royal Government of Cambodia (RGC) is addressing its progressive development agenda, since water resources are vital drivers of the Kingdom’s modern economic expansion in agriculture, industry, hydropower, navigation, and tourism.

What are the government’s efforts to address the wastewater issues in Cambodia?

RGC has recognized the importance of wastewater management, and, as such, is also showing commitment to addressing it as part of broader efforts to improve: public health; environmental sustainability; and socio-economics.

Here are several of their key initiatives:

- Policy and Regulation: Government work continues on strengthening policies and regulatory frameworks that guide wastewater management efforts and pollution control, including: setting standards for effluent discharge; establishing monitoring systems; and enforcing compliance to ensure that industries and municipalities can safely and effectively treat their wastewater before getting rid of it. Notable wastewater management-related policies, regulations, and plans include:

- The Law on Environmental Protection and Natural Resource Management (Enacted in 1996 and revised in 2007)

- The National Policy on Sanitation and Clean Water Supply (Launched in 2000 and revised in 2010)

- Sub-Decree on Wastewater Management (Issued by the Ministry of Environment)

- National Strategic Development Plan

- National Strategy for Rural Water Supply, Sanitation and Hygiene 2014-2025

- Master Plan on Drainage and Sewerage Improvement 2035

- Phnom Penh Green City Strategic Plan 2017-2026, etc.

- Investment in Infrastructure: The government has invested in the construction of wastewater treatment plants and sewerage systems in urban areas. Projects such as the Phnom Penh Wastewater Management Project aim to expand the area of sewerage coverage. Further, plans call for the construction of treatment plants so as to mitigate pollution and improve treatment capacity.

- Capacity Building: The government has been working to strengthen institutional capacity for wastewater management. This includes training programs for government officials, technical staff, and stakeholders who are otherwise involved in managing water and sanitation.

- Public Awareness and Education: Ongoing efforts exist to raise public awareness about the importance of proper wastewater management and sanitation practices. For example, education campaigns for communities, schools, and businesses are designed to effect behaviour change as a means to reduce the discharge of untreated wastewater.

- Public-Private Partnerships and Collaboration: The government collaborates with international organizations, development partners, and the private sector to support wastewater management initiatives. This includes funding, technical assistance, and knowledge-sharing so people can work together to put projects into practice.

What are the collaborations between RGC and international organizations to develop wastewater management in Cambodia?

Cambodia is working on improving water supply and developing the sanitation systems with various projects that are financed by development partners. Notably, the involvement of private companies like Fluence Corp. gives an indication of global interest in businesses that are coming to Cambodia to lend their experience and expertise in wastewater management on new and ongoing projects. Well-known projects include:

Japanese International Cooperation Agency (JICA): More than 25 million USD has been slated for the Sewerage System Development Project, which aims to improve sanitation and develop Phnom Penh’s sewerage sector. This work will be done by constructing a wastewater treatment facility, building sewage pipes, and adding a sludge treatment plant in Choeung Ek commune. That plant would enable the city to treat 5,000 cubic meters of wastewater each day, before it is discharged into local rivers.

Since April 2019, three Japanese experts have been looking into ways to strengthen sewerage management’s legal and institutional frameworks. Further, the construction of Phnom Penh’s first wastewater treatment plant broke ground in February 2022, and was inaugurated in December 2023. JICA’s assistance also lent technical support to upskill the officials from the Department of Public Works and Transport of the Phnom Penh Capital Administration (PPCA) and Ministry of Public Works and Transport (MPWT) officials, so they could together operate, maintain, and manage sewerage efficiently through a technical cooperation project. This project is, aptly, called “Project for Capacity Development in Sewerage Management of PPCA & MPWT”.

The Asian Development Bank (ADB) has provided 25% of all external assistance to support water and sanitation development in Cambodia. In 2019, ADB approved 49 million USD to support the government’s water and sanitation development. They’ve also paid for the development of infrastructure in provinces such as Siem Reap, Battambang, Preah Sihanouk, and Kampong Cham. Moreover, ADB has supported capacity-building initiatives that aim to strengthen both institutional and technical capacity of government agencies that are responsible, and closely involved, in the planning, operation, and maintenance of wastewater management.

Agence Française de Développement (AFD) has supported Cambodia’s water and sanitation sector, accounting for 336 million USD in loans and grants. One of the biggest water treatment plants, designed to increase water production capacity in Phnom Penh by 65%, was financed by a 184 million USD loan from AFD, 100 million USD from the European Investment Bank, 15 million in grants from the European Union, and an 80 million investment from Phnom Penh Water Supply Authority (PPWSA).

Fluence Corporation: In line with the Preah Sihanouk Declaration by the Partnership in Environmental Management for the Seas of East Asia (PEMSEA), the Ministry of Land Management, Urban Planning and Construction (MLMUPC) has brought in Fluence Corp. to put Fluence’s Membrane Aerated Biofilm Reactor (MABR) technology to work at the Port of Sihanoukville. This is Cambodia’s main seaport, and its only deep-sea port.

US-based Fluence Corp.’s expertise in wastewater solutions had helped launch a wastewater treatment plant in July 2023, called PS3 Wastewater Treatment. It can process 20,000 cubic meters daily. Noteworthy for its small footprint, low energy consumption, and adherence to international discharge effluence requirements, the project aligns with ASEAN’s “Blue Economy” vision, by which ASEAN aims to create value by advancing sustainable practices that promote sustainable, inclusive economic and social development related to marine and freshwater activities and livelihoods.

Fluence’s wastewater solutions are integral to three major projects in Sihanoukville. The first plant, PS1, treats 5,200 m³/day, while the second, PS2, handles 7,200 m³/day. Both have been operational since 2021. Due to scarce land, PS1 is built 5 meters from the coast with a special design to resist subsidence and seawater corrosion. PS2 and the planned third plant are designed to fit narrow coastal channels without affecting river flow, emphasizing compact and space-saving designs. These plants treat wastewater mainly from residential and commercial sources collected by new pipelines and some open-collection sewage from older areas. Effluent standards are set to control pollutants and protect Sihanoukville’s coastal environment and tourism resources. The average energy consumption of the PS1 plant is 0.358 Kwh per tonne of wastewater, while PS2 consumes 0.321 Kwh per tonne. The use of advanced technologies and environmentally-aware practices places the facility in a position to much more comprehensively treat wastewater.

Fluence Corp.’s focus on innovation and sustainable solutions for PS3 gained recognition when the company won the Singapore Business Review‘s International Business Award for Engineering Excellence on 23 April 2023.

What business opportunities exist for experts in the sewerage sector, for new projects in Cambodia?